Retirement Planning for Beginners

Wiki Article

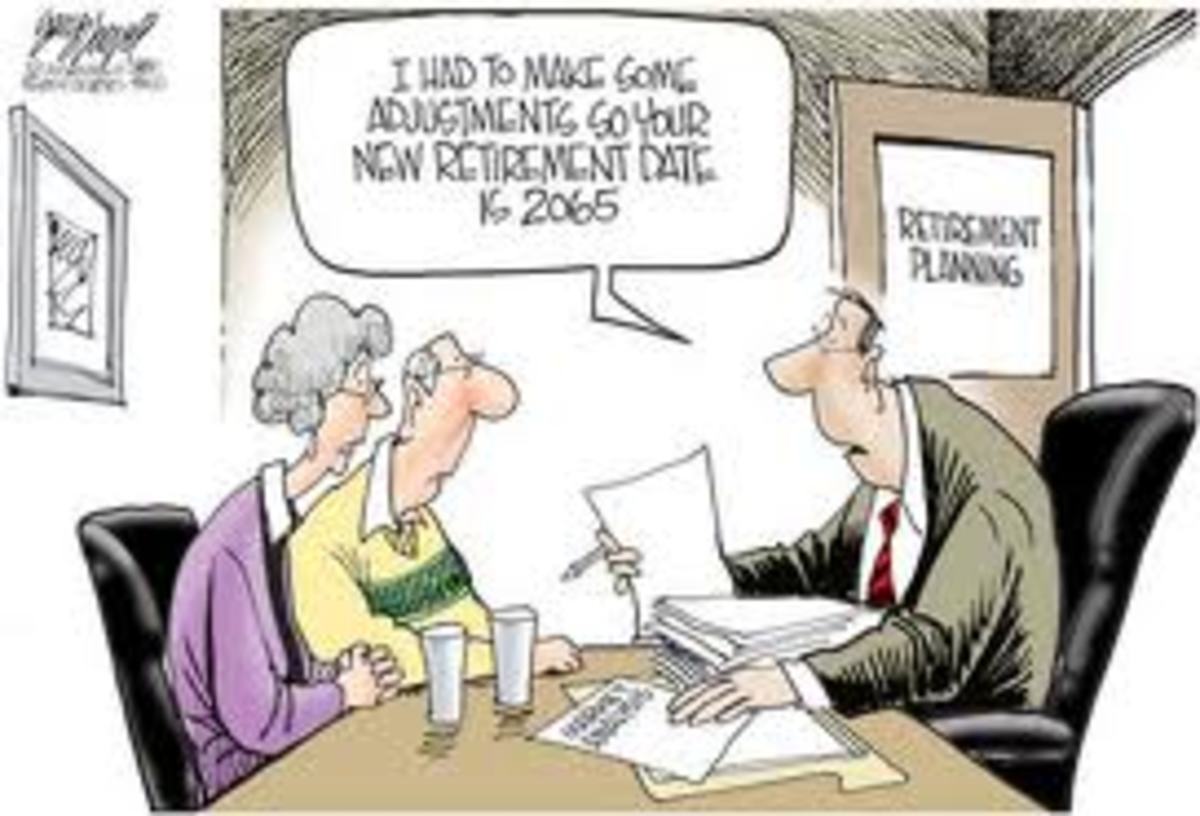

The Main Principles Of Retirement Planning

Table of ContentsNot known Details About Retirement Planning The 5-Second Trick For Retirement PlanningHow Retirement Planning can Save You Time, Stress, and Money.Retirement Planning Can Be Fun For Anyone

12 percent. By 2007, that exact same 175 monthly stood for a modest 7. 47 percent of what they made. By 2007, the other 2 couples were spending a great deal even more money than Sam and Kate. But that didn't matter. These 2 early risers still soared higher. According to, they would certainly have had concerning 1 million by the time they were 65 years old without ever increasing the month-to-month quantity they invested.They didn't start to spend up until they were 35 years old. They spent 600 a month (7,200 annually) in 1987. It represented 42. 03 percent of their disposable revenue oops. However, by scrimping so hard, by the time they were 65 years of ages, they likewise had about a million pounds.

Therefore, they weren't able to spend as much of their revenue on the finer things in life. When Sam and also Kate asked Stuart and Lisa to join them for a South African safari, they could not afford it. Their monthly retired life savings consumed up far excessive of their income.

Some Known Facts About Retirement Planning.

They would certainly have saved a total of concerning 84,000 to accumulate 1 million. Stuart and Lisa began to spend 10 years later on.

As a result, they had to save about 432,000 to reach their million-pound landmark by age sixty-five. If they had begun to invest 10 years later on (at age 55) they wouldn't have actually reached that objective even if they had actually spent every cent they made! We are not claiming you require 1 million to retire. retirement planning.

We all have objectives as well as we will still have objectives when we retire. For a senior citizen, it might be tough because most goals require money as well as if at that factor in your life, you do not have adequate retired life cost savings, you might not be able to attain your retirement goals.

It can be to get a dream automobile, take place a dream vacation or acquire a dream home. The fact is, if you do not have the cash money, you can not achieve the goal. This is on significance of retirement planning. With a retirement that permits you to conserve as well as invest the funds in your pension, you can grow the funds and make them adequate for post-retirement.

The 9-Minute Rule for Retirement Planning

While there is nothing incorrect with discovering what the world has to provide, and experiences are certainly a terrific financial investment in on your own, you need to also prepare for your future. Believe long as well as hard regarding it.Prior to you know it, the years have actually passed as well as you might not have any type of financial savings entrusted to trend you over. Having a substantial quantity of money set aside for your retired life years can assure you of a comfy life in the he said future. This allows you to be financially independent, not needing to count on kids, grandchildren, or relatives to maintain you when the time comes - retirement planning.

Do invest in experiences. Also allocate part of your cash where it can grow.

There are many my website benefits to retirement preparation, consisting of: The main factor retired life preparation is very important is that it will certainly supply you as well as your loved ones with economic safety and security. As discussed, Social Safety is not most likely to sufficiently offer you during retired life, particularly as people live longer lives. Sometimes, people need to leave the workforce earlier than anticipated, either since they can not literally function, or due to the fact that they're stressed out.

What Does Retirement Planning Mean?

You will not need to choose from a place of anxiety when you know that your private retirement account or firm pension is established Read Full Report up to care for you as well as your household in the future. If you function with a tax obligation advisor on your retirement, it can be structured to lessen the quantity of taxes you'll pay accurate you have actually saved.

If you have to fret about cash throughout retirement, it's not mosting likely to be a satisfying experience. For the majority of people, retirement is the time when they can ultimately check things off their pail listing, particularly as it connects to traveling and also seeing the world. If you have actually intended ahead, this kind of disposable revenue ends up being feasible.

For some that retire, it might suggest offering their house as well as relocating to a location with sunnier weather condition. retirement planning. For others, it could imply getting a reverse home mortgage to hold on to a family members residential or commercial property. Whatever the instance might be, speaking to a tax advisor regarding the future can make retirement a lot more delightful.

If you make the investment in intending for your retired life currently, you won't have to be one of them. People are living much longer, which implies retirement is obtaining longer for numerous Americans.

Report this wiki page